Financing solutions for

Southeast Asia and Bangladesh

Unlock opportunities and manage risks: Export financing solutions for your business

Competent on site - Singapore

Since July 2023, business administration graduate Alexandra Lutz has been working as a financing expert in Singapore. With a regional mandate, she supports German export business in Southeast Asia and Bangladesh.

As an expert, she is familiar with the diverse interests and needs of foreign buyers, local and export-financing banks, and German exporters – including those with operations in the region.

As the central contact for financing solutions, she helps make export transactions more secure and competitive by arranging appropriate financing and risk-mitigation instruments and aligning the interests of all parties involved.

She performs this multifaceted role every day with dedication and passion for sustainable business development.

Get in touch: +65 6433 6330

Advisory services and risk mitigation for your successful market entry into Southeast Asia and Bangladesh

In-depth local expertise is essential in the dynamic markets of Southeast Asia and Bangladesh.

Alexandra Lutz advises German exporters and export-financing banks on the ground, develops tailor-made financing solutions, and assists foreign importers in gaining access to the Federal Government’s Export Credit Guarantees.

By participating in trade fairs, delegation trips, and through targeted networking activities, she builds valuable links between German companies, local banks, and business partners.

In doing so, she fosters sustainable business relationships and facilitates market entry for German exporters in the region.

With the Export Credit Guarantees of the Federal Government, German companies benefit from comprehensive protection against commercial and political risks, while importers gain planning certainty through secured financing solutions.

In this way, Alexandra Lutz helps enable secure, efficient, and successful export transactions – right on site.

Export opportunities in the region

Opportunities & potential

"The ASEAN region is one of the fastest-growing economic areas worldwide, with strong demand for infrastructure, technology and sustainable solutions. This offers significant opportunities for German exporters."

Trust & proximity on site

"Many exporters value the fact that I am on the ground – joint customer visits make all the difference. This enables us to discuss financing options directly and develop tailor-made solutions."

Financing offers as a competitive advantage

"A structured financing offer backed by an export credit guarantee can be a real door opener in Asian markets – particularly in a region where payment terms are often decisive for purchasing decisions."

News and publications

ECG Report 357

November 6, 2024

Export financing in Asia: ECA-covered financing - flexible products and local presence as success factors

ECG Report 345

September 25, 2023

Competent on site - Alexandra Lutz new financing expert in Singapore

#3 Export Echo

Alexandra Lutz about growth and opportunities in the ASEAN region

Major projects in Southeast Asia and Bangladesh

Country information | Southeast Asia and Bangladesh

Do your foreign customers know the advantages of Hermes Cover?

Share our information on Your way to buy 'Made in Germany' for foreign importers with your customers:

Your way to Hermes cover

I can advise you on all questions relating to export insurance

During the consultation, we discuss your specific export project in detail, clarify questions and find the right type of cover for your foreign business.

How to submit an application

It's very easy in the myAGA customer portal. Register via this link: my.agaportal.de.

I will assist you with the application process, including the cost indication, and am available to answer any questions you may have.

We check your application

The main criteria when assessing your export business for cover with an export credit guarantee are:

- The creditworthiness of the foreign customer

- The respective country risk

- The proportion of German value added

- Usual contractual terms (payment terms and term)

- Compliance with environmental, social and human rights standards

We secure your export business

After a positive check, you will receive

Before signing the contract:

- a binding, provisional commitment

And after conclusion of the contract

- the letter of acceptance (final commitment)

- the declaration of warranty (certificate of cover)

- the invoice

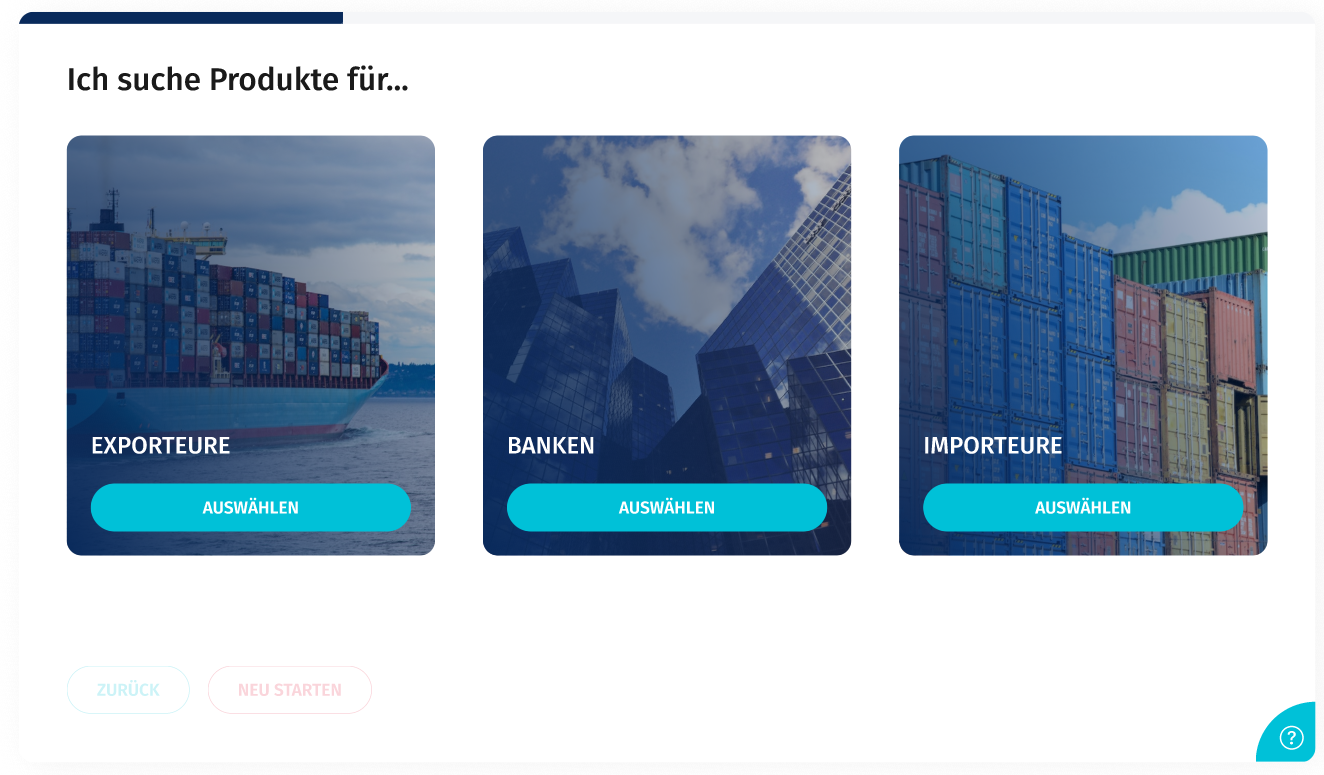

Which export credit guarantee suits your project?

We offer you various options for securing your receivables from export transactions or from the financing of a foreign transaction:

Downloads

With us you are always informed

You can find relevant news in the ECG Report or register directly for the newsletter with all the information on export credit guarantees. You can also find events near you in our event portal, e.g. our IHK consultant day.