Covering Risks

Protection of your export credits against payment defaults

What are export credit guarantees for?

State export credit guarantees are a key foreign trade promotion instrument of Federal Government. They protect exporters against bad debt losses for commercial or political reasons and in many cases they are a prerequisite for the necessary funding of a transaction to be made available.

So-called Hermes Cover is only to be had where the private industry does not offer appropriate or sufficient insurance cover facilities. Consequently, the Federal Government concentrates on export credit guarantees for emerging economies and developing countries. They help German exporters to open up markets, which are difficult to access, and to maintain business relations in challenging circumstances.

With the provision of an export credit guarantee the risk of bad debt losses is, to a large extent, transferred from the exporter and/or the financing bank to the Federal Republic of Germany. For this, the policyholders pay a premium commensurate with the risk.

Hermes Cover is granted in accordance with national and international rules and is conditional upon specific requirements being met. The two key criteria for state cover are the eligibility for cover and the justifiability of the risk.

Euler Hermes Aktiengesellschaft is in charge of the management of the Export Credit Guarantees of the Federal Republic of Germany.

What are the key criteria for cover?

Eligiblity for cover

Export transactions are considered to be eligible for cover if they fit in with the supporting intentions of the Federal Republic. This means that exports transacted by small and medium-sized enterprises are regarded as particularly deserving of support. Thus, the export credit guarantees offer German exporters fair chances in international competition.

However, not every export transaction is eligible for cover. Restrictions on eligibility may be based on e. g. the type of goods concerned, the country of destination, a combination of the two, the parties to the contract, the payment terms agreed or other issues related, for example, to environmental or social aspects, human rights or corruption.

Justifiability of the risk

The Federal Government will only cover transactions which are justifiable in terms of the commercial and political risks involved. In this context, the creditworthiness of the foreign buyer, i.e. his ability to meet his financial obligations in future, is scrutinized. Besides, the country risk plays an important role in determining the risk.

Particular political interests of the Federal Republic of Germany may permit the granting of cover for export transactions with a higher risk. These may involve labour market initiatives, issues of structural or regional economic importance or foreign and development aid policy.

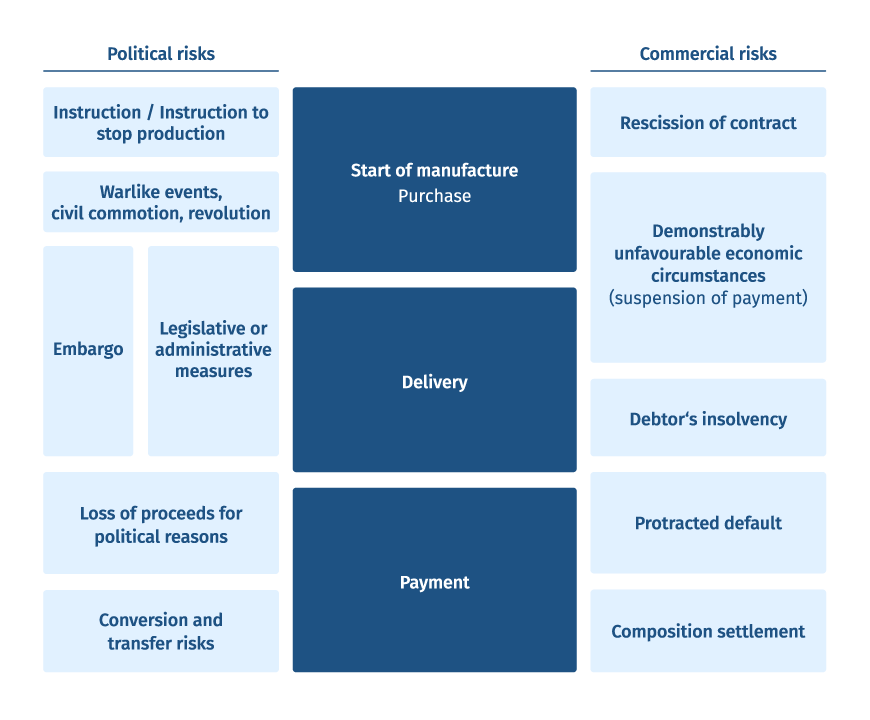

Protection against political and commercial risks

Export credit guarantees protect your company against bad debt losses for political and commercial reasons. For example, warlike events, civil unrest or payment embargoes because of exchange restrictions can be political causes of loss. Commercial causes of loss are, for example, the protracted default of a buyer or his insolvency.

Great variety of products for exporters and banks

Whether you export on short or longer payment terms, to one or several buyers, only once or regularly, whether you make use of bank loans or buyer credits or wish to finance complex projects: There exist suitable forms of cover for every export transaction – the Export Credit Guarantee scheme offers a comprehensive range of products.

There are cover facilities available for the period before and after dispatch of the goods. Manufacturing risk cover protects you against risks during the production of the goods to be exported. Export risks arising after the delivery of the goods can be covered under export credit guarantees.

In order to finance the export transaction your foreign buyer may either make use of a supplier credit or a buyer credit. In the case of a supplier credit, the German exporter applies for cover for his transaction. If a bank finances the export transaction under a buyer credit, it can protect itself against the risk of non-payment with Hermes Cover (buyer credit cover).

Protected from the outset

If requested, a transaction is covered during the entire period before and after shipment of the goods until all outstanding amounts are paid. Please find out first which cover option is best suited for your supplies or services before you submit an application for cover. In this way it is guaranteed that you get the best possible protection against the specific risks of your transaction.

Foreign business – yes, but on a safe basis

As a matter of principle, Hermes Cover is available to all German exporters irrespective of the company’s size and the volume of the export transaction.

Business transacted by small and medium-sized companies is considered to be particularly deserving of support.

Your contact persons