Contract bond cover

Enhanced cover for bonds for exporters

Protection against unfair calling of the advance payment bond

You are required by the foreign buyer to provide a contract bond to ensure satisfactory performance of the contract? A contract bond cover enables you to protect yourself against losses due to politically occasioned or unfair calling of such a bond.

Worth knowing: You will receive an indication as to the amount of the premium payable in the course of the online application process, that is before actually submitting an application for cover.

Contract bond cover at a glance

Target group

German export firms

Insurable risks

Contract bond cover offers protection against the loss of the guarantee amount in cases of

- fair calling of the bond by the foreign buyer because the exporter has failed to fulfil his obligations due to political events abroad;

- fair calling of the bond by the foreign buyer because contract performance has become impossible due to embargo measures taken by the Federal Republic of Germany;

- unfair calling of the bond due to political events abroad;

- unfair calling of the bond due to other circumstances which make the claim to reimbursement of the guaranteed sum unenforceable for political or commercial reasons

Examples of use

- Bid bonds

- Advance payment bonds

- Performance bonds

- Maintenance bonds

- Customs guarantees

- Retention guarantees

Special features

A contract bond cover can be issued only in combination with a manufacturing risk cover or a supplier credit cover.

Premium

One-off premium calculated as percentage of the guaranteed sum and, as the case may be, specific administrative fees

Uninsured percentage

5% for all risks

Contract bond cover: Your advantages at a glance

Comprehensive protection

Our contract bond cover will compensate the loss of the bond amount in many cases – for example, in the case of fair calling for political reasons originating abroad, embargos, unfair calling for political reasons or other unlawful reasons.

Digital

You can apply for contract bond cover quite easily in our customer portal myAGA.

Combinable

Our contract bond cover must always be applied for together with a manufacturing risk cover and/or a supplier credit cover.

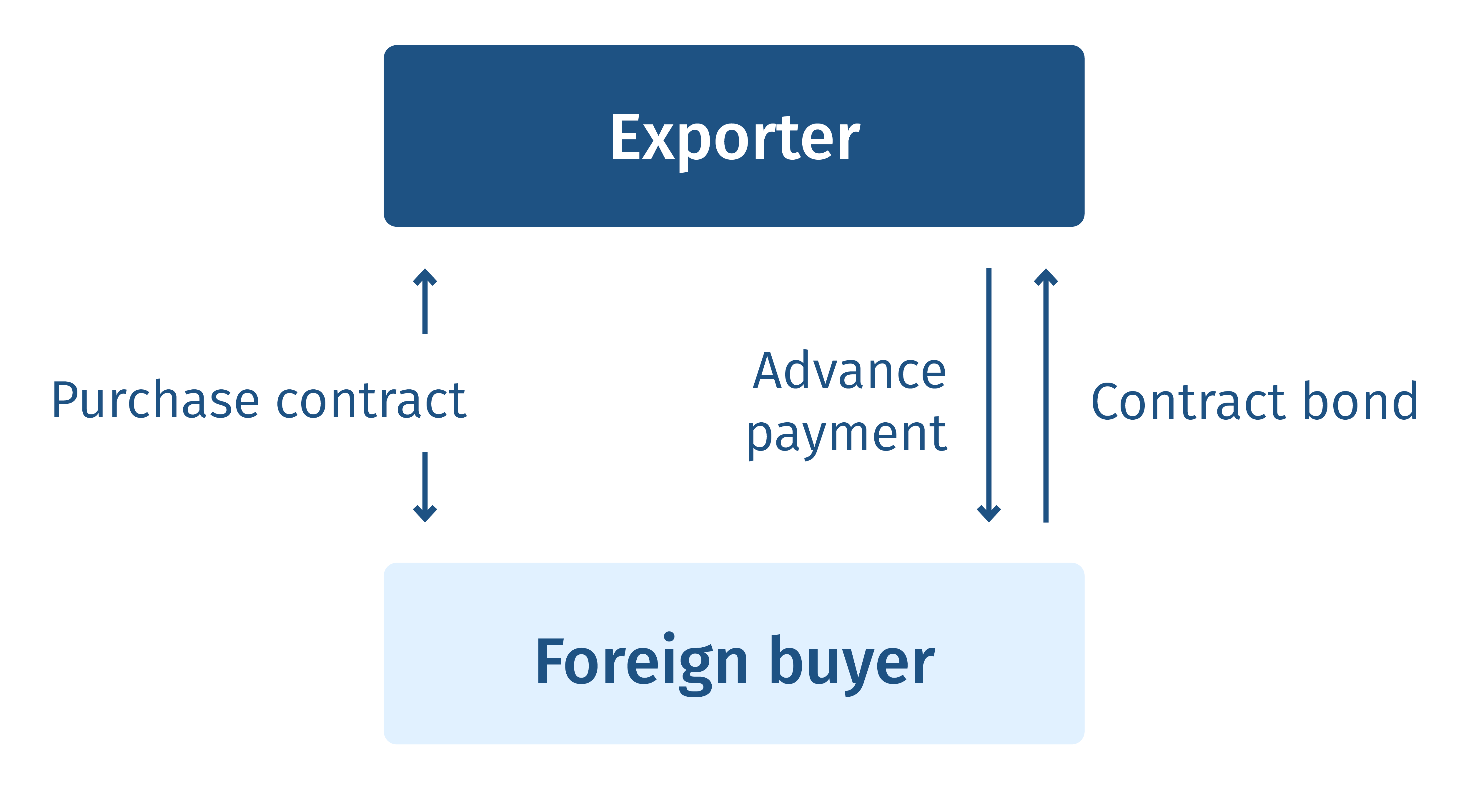

How does contract bond cover work?

In the course of an export transaction, an exporter often has to furnish contract bonds to ensure his satisfactory performance of the contract. The most common types of contract bonds are the advance payment, the performance and the maintenance bond. The bid bond should also be mentioned in this context, although at the time of its validity a contract does not yet exist; the risks covered are modified accordingly. A contract bond is normally issued by the German exporter’s company bank in the form of an “unconditional on-demand bond”. Thus the buyer has the certainty that he will receive the guaranteed amount immediately, i.e. on first demand, in the event of a breach of contract on the part of the German exporter.

For the exporter this undoubtedly legitimate interest of the buyer involves the risk that the contract bond may be called even if the exporter is not responsible for the breach of contract. It is as protection against this risk that the Federal Government offers contract bond cover.

Applying for contract bond cover

You can apply quite easily for this product online in the myAGA customer portal. Please submit your online application there in order to apply for cover for your export transaction under a contract bond cover. For this purpose please register once and comfortably with just a few steps with our myAGA customer portal. If you already use myAGA, you can log on directly with your access data.

If you need assistance with the application or if you have any questions regarding the suitable product for you, please contact our business consultants.

Downloads

FAQs - contract bond cover

What risks are covered?

A contract bond cover offers protection against the loss of the bond amount in cases of

- fair calling of the bond by the foreign buyer because the German exporter has failed to fulfil his obligations due to political events abroad;

- fair calling of the bond by the foreign buyer because contract performance has become impossible due to embargo measures taken by the Federal Republic of Germany;

- unfair calling of the bond due to political events abroad;

- unfair calling of the bond due to other circumstances which make the claim to reimbursement of the guaranteed sum unenforceable for political or commercial reasons.

Can or must contract bond cover be combined with other types of cover?

A contract bond cover can be issued only in combination with a manufacturing risk cover (see Product Information "manufacturing risk cover") or a supplier credit cover (see Product Information "supplier credit cover"). Only for bid bonds an isolated contract bond cover can be issued if the exporter applies for it; in that case only the risks of unfair calling are covered.

What horizon of risk is covered?

Cover takes effect with the issuance of the contract bond and ends with its expiry or, in the case of unfair calling by the foreign buyer due to other circumstances, with the full reimbursement of the guaranteed sum.

Do you have any additional questions regarding contract bond cover?

Our experts will be pleased to answer any questions regarding a contract bond cover and will guide you step by step through the application process if desired.

Your Contacts