Loss and indemnification

Important to know in the event of a loss

What needs to be done if a loss threatens?

The covered risk of a payment default is likely to materialise if your foreign debtor experiences financial difficulties and your invoice remains unpaid. In order to guarantee a smooth loss settlement, it is recommended to contact us in good time. We will be pleased to assist you and discuss and agree the necessary steps with you.

There is no need to worry – we will assist you every step of the way.

Reporting risk-aggravating circumstances

Please notify us without delay in writing of any circumstances that are likely to result in a payment default (e. g. delay in payment, a request for extension of the payment period and a deterioration of the financial situation). Please also inform us of the steps you have already taken and/or intend to take to recover the debts.

Obtaining approval before making further deliveries

If you intend to make further shipments to the foreign debtor despite the existence of risk-aggravating factors, you require the prior written approval of the Federal Government.

How to minimise losses

Please initiate all appropriate measures to prevent or minimise a loss and, in doing so, proceed with all due and reasonable care dictated by sound business practice.

Repayment with extended payment periods?

If you file a claim for indemnification, this will result in the suspension of cover. If, alternatively, you wish to agree a repayment plan with new maturities (prolongation) with your foreign buyer in order to prevent a loss, this usually requires the approval of the Federal Government.

Your contacts

Preconditions for filing a claim for indemnification

If a loss occurs, you can file a claim for indemnification. The preconditions for filing a claim are that

- cover exists

- accounts receivable are uncollectable / (where applicable) security interest cannot be enforced

- the legal validity of the claim to payment is proven

- the occurrence of an event of loss is proven

- you perform the duties incumbent on you

Please do not hesitate to contact our experts if you have any questions so that your bad debt loss can be rapidly settled.

What types of events of loss exist?

Commercial loss

In the case of a commercial loss, the reason for the payment default is to be found in the sphere of the foreign buyer, for example, because of

- events defined as insolvency, such as bankruptcy, a composition settlement in or out of court, unsuccessful judgement of execution

- protracted default persisting for more than six months in connection with wholeturnover policies and supplier credits or one month in connection with buyer credits

Once the indemnification has been paid, the claim passes to the Federal Government up to the indemnified amount. The exporter remains bound to continue enforcing the claim for payment in accordance with the instructions of the Federal Government. Where prior agreement has been reached, the Federal Government will share the legal costs incurred. We will be pleased to assist you in choosing the institutions to be retained in order to enforce the claim.

Political loss

In the case of a political loss, the reason for the payment default is to be found in the sphere of the country in which the foreign buyer is domiciled, for example, because of

- general legislative or administrative acts (e. g. freezing of payments, payment moratorium, debt rescheduling)

- warlike events, riots or revolution in the buyer country

- non-conversion, non-transfer of amounts deposited abroad

A political event of loss is deemed to have occurred if and when the Federal Government acknowledges the political event that caused the payment default in respect of the country concerned. In most cases, legislative or administrative measures are the cause of loss. In such cases, it may take longer until a political event of loss is recognised. In the meantime, the case will be treated as commercial loss.

Downloads

Buyer credit cover - application for compensation

Tutorial for compensation applications for buyer credit cover

You can now apply for indemnification for buyer credit cover online via our myAGA customer portal. Our video tutorial will guide you through the form (German version only, please use subtitles).

FAQs on loss and indemnification

When is the right time for submitting a claims application?

Basically, a claims application can be submitted once the claims waiting period has expired. The claims waiting period is the period of time set between the due date of the amounts receivable and the occurrence of a claim under the event of loss. This depends on the relevant event of loss and the form of cover in question. Thus, in the case of supplier credit cover or wholeturnover policies, the most common event of loss, protracted default, is deemed to have occurred if the foreign buyer fails to make payment within six months after due date. In the case of buyer credit cover, however, protracted default is deemed to have occurred already after one month after due date. It has to be taken into account that a claims application may have repercussions for the foreign buyer in connection with existing business and transactions to be covered. If the non-payment of the amount receivable is due to the insolvency of the foreign debtor or a court or out-of-court settlement between the creditors has been reached, the insured event is deemed to have occurred upon the application of or assent to the composition proceedings. Nevertheless, you will still not receive indemnification prior to the due date of the covered amounts receivable. The same applies in the case of an unsatisfied execution or a suspension of payments evidenced by confirmation from a credit agency or Chamber of Commerce.

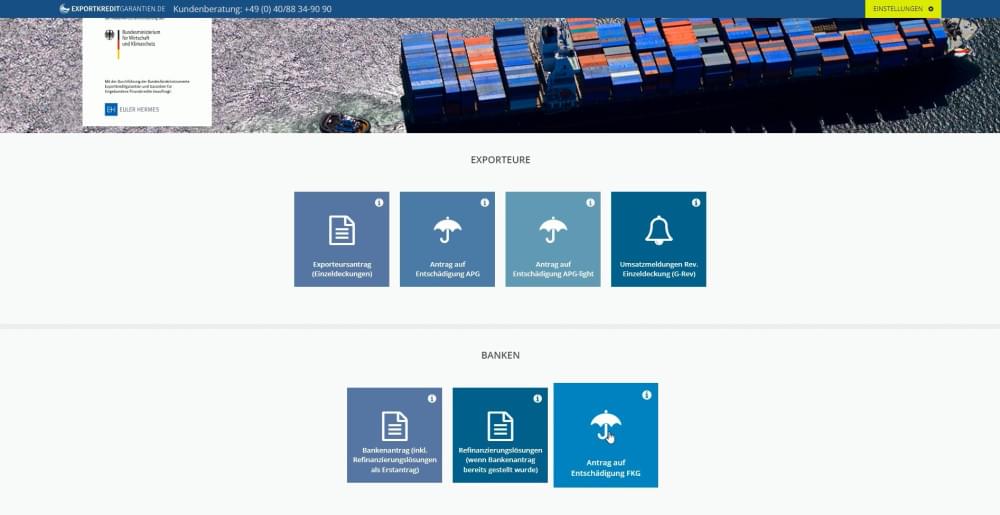

How to submit a claims application?

You, as exporter, are requested to complete the claims application form called “Antrag auf Entschädigung” made available by Euler Hermes Aktiengesellschaft. It will provide guidance on giving a detailed description of your transaction in respect of which indemnification is applied for and fully advise you on what documents you are required to submit for claims examination. The claims application forms are available at Euler Hermes Aktiengesellschaft, Geschäftsbereich Exportkreditgarantien des Bundes, at all branch offices or as download on the Internet. In the case of buyer credit guarantees, political events of loss and cover for transactions with public buyers the application can be made without any formality.

What documents have to be enclosed with the claims application?

The following documents – as far as applicable – must be submitted together with the claims application:

In the case of supplier credit guarantees or wholeturnover Policies:

- export contract or order/order confirmation,

- evidence of the valid creation of security interests where applicable

- evidence provided by the bank that the amount of the down-payment has been credited,- shipment documents

- invoices relating to the uncollectible debts,- statement of the foreign buyer’s account, starting six months before the first uncollectible debt

- documents of down-payments and other instalments made

- reminders/collection correspondence

- documents evidencing the recourse to any security interests you may have

Documentary proof of the event of loss, if required:

- documentation of the institution of insolvency proceedings,

documentation of the institution of composition proceedings,

documentation of an out-of-court settlement,

evidence of an unsatisfied execution.

In the case of buyer credit guarantees:

- loan agreement,

- evidence of the valid creation of security interests where applicable,

- evidence provided by the bank that the exporter has received the down-payment,

- proof that the preconditions for the disbursement of the buyer credit have been met, reminders,

- further documents proving the event of loss where appropriate,

- documents evidencing the recourse to any security interests that may exist,

- repayment schedule.

In the case of manufacturing risk guarantees:

- export contract,

- evidence of the valid creation of security interests where applicable,

- evidence provided by the bank that the exporter has received the down-payment the production started,

- correspondence with the foreign buyer relating to the loss

- further documents proving the event of loss, e.g. rescission of contract where applicable,

- first approximate estimate of the prime costs incurred so far.

Once the event of loss has been recognised on its merits, the policyholder must provide an expert opinion as to the level of the prime costs incurred prepared by an auditor or other expert in accordance with the basic principles of pricing on total production cost basis (LSP).