Credit Confirmation Risk Cover

Buyer credit cover against credit confirmation risks

Insuring credit confirmation risks as bank

With buyer credit cover against credit confirmation risks a bank insures itself against the risks involved in the confirmation of a letter of credit that has been issued to finance an export transaction of a German company. It is available in particular for confirmed letters of credit and irrevocable purchase commitments.

Good to know: Buyer credit cover against credit confirmation risks is not an independent form of cover. For this a Buyer Credit Guarantee is amended by Special Conditions. As customary with isolated buyer credit cover, the bank has to provide all relevant details of the export transaction and has to furnish a Letter of Undertaking and a Declaration on Combating Bribery signed by the exporter. Proportionate cover of a partial amount is possible on application.

Credit Confirmation Risk Cover at a glance

Target group

- German banks

- Branch offices of foreign banks in Germany

- Foreign banks (under certain conditions)

Term of the covered transactions

Period of validity of the confirmed documentary credit (up to 12 months) plus a credit period of up to 5 years. If the credit period is longer than 2 years, the requirements of the OECD Consensus must be observed.

Insurable risks

Buyer credit cover against credit confirmation risks offers protection against payment default particularly if

- the borrower, i.e. usually the foreign bank which opens the letter of credit, becomes insolvent

- the borrower fails to make payment within one month after the due date (protracted default)

- adverse measures are taken by foreign governments or warlike events arise

- local currency amounts are not converted or transferred

Premium

- One-off premium calculated as a percentage of the credit amount covered (interest excluded) as well as specific processing fees

- For a detailed calculation based on the horizon of risk there is an calculation tool available.

Uninsured percentage

- 5% for all risks

How does credit confirmation risk cover work?

Downloads

FAQs Credit Confirmation Risk Cover

How can documentary credits be used in export business?

Especially where short-term trade finance is required in foreign business, documentary export credit is frequently used (letter of credit = L/C). Under this specific type of credit agreement a bank undertakes, in accordance with the instructions of its client (i.e. the importer abroad), to make payment to a third party (i.e. the German exporter) or to commission another bank to do so if certain conditions are met (among other things the presentation of specific documents).

For instance, the exporter (beneficiary) agrees with his buyer abroad (importer) that he (as applicant) requests his bank (issuing bank abroad) to open a letter of credit. This bank issues the letter of credit and sends it the exporter’s bank. Thus the exporter knows for sure that he will receive payment from the issuing bank and the importer has always the guarantee that payment will not be made until the documents evidencing the goods/services have been duly presented in compliance with the terms and conditions of the letter of credit. In order to increase the security for the exporter further, his bank can confirm the letter of credit, i.e. assume a bare acknowledgement of debt on request of the issuing bank. If there is no order or authorization from the issuing bank abroad, the exporter’s bank may, however, give an independent, irrevocable undertaking to pay in the form of a silent confirmation.

What is the link between the Credit Confirmation Risk Guarantee and the export transaction?

The letter of credit which is to be covered must be based on an export transaction that meets the usual standards applicable to Federal export credit guarantees. Credit confirmation risk cover is granted in favour of the bank, separate supplier credit cover in favour of the exporter is not required. The bank has to give an exhaustive description of the underlying export transaction in the application form and submit a specific Letter of Undertaking and Declaration on Combating Bribery signed by the exporter.

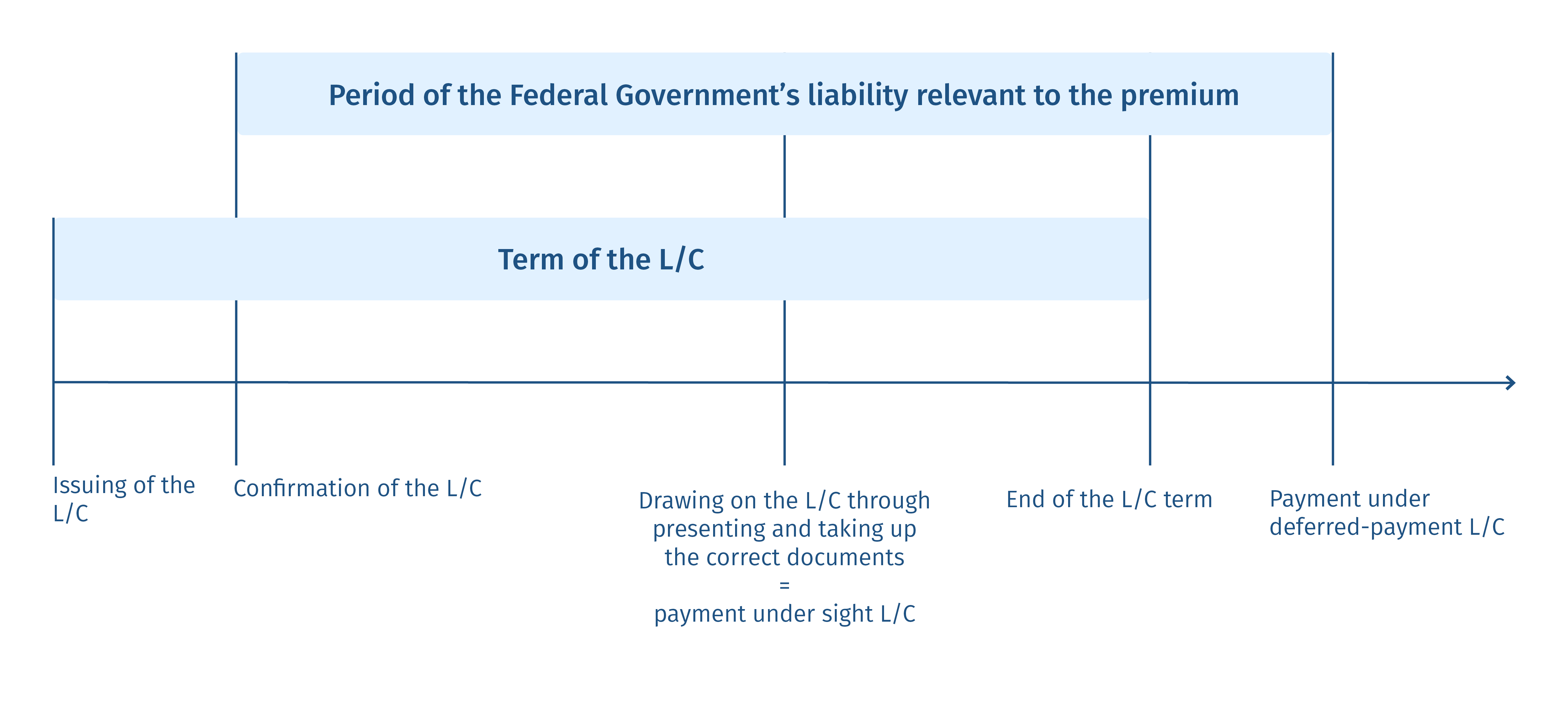

What horizon of risk is covered?

Cover takes effected when the letter of credit is confirmed and ends with the full payment of the covered amount owing, i.e. the reimbursement of the credit amount through the issuing bank abroad after the documents stipulated in the letter of credit have been taken up or the lending period has expired. In order to effectively protect the confirming bank, the Federal Government waives its right to interfere in the cover in case of a deterioration of the risk - contrary to standard buyer credit cover - already with effect from the confirmation of the L/C. As a rule, the period of time that can be covered is limited to 360 days for the credit confirmation period plus five years for the lending period.

Where medium credit terms (two years or more) are agreed, the requirements of the OECD Consensus (a.o. down payment requirement) have to be met.

Do you have any additional questions regarding credit confirmation risk cover?

Our experts will be pleased to answer any questions regarding credit confirmation risk cover and will guide you step by step through the application process if desired. Please do not hesitate to contact them.

Your Contacts