Framework credit cover

Insuring export business as bank

Bundling and covering individual loans under a general loan agreement

With a framework credit cover, banks can insure their receivables arising from individual loans granted under a general loan agreement (credit line) to finance German export transactions. Instead of negotiating numerous individual loan agreements, framework or blanket credits with foreign borrowers, the fixed credit line can be used with individual loans. In addition to simplifying the process, this can also reduce costs.

Framework credit cover at a glance

Target group

- German banks

- German branch offices of foreign banks

- Foreign banks (under to certain conditions)

Term of the covered transactions

Medium/long-term (payment period of 24 months or longer)

Insurable risks

Framework credit cover offers protection against payment default, particularly if

- the foreign buyer becomes insolvent

- the foreign buyer fails to make payment within one month after due date (protracted default)

- adverse measures are taken by foreign governments or warlike events arise

- local currency amounts are not converted or transferred

Premium

- An individually calculated percentage of each individual loan amount (interest excluded) as well as specific processing fees

- For a detailed calculation there is an interactive premium calculator (German version only) available.

Uninsured portion

- 5% for all risks

Supplementary cover

If required, framework credit cover can be supplemented with

- a securitisation guarantee (to refinance export credit loans – enhanced conditions in favour of the refinancing institution)

How does framework credit cover work?

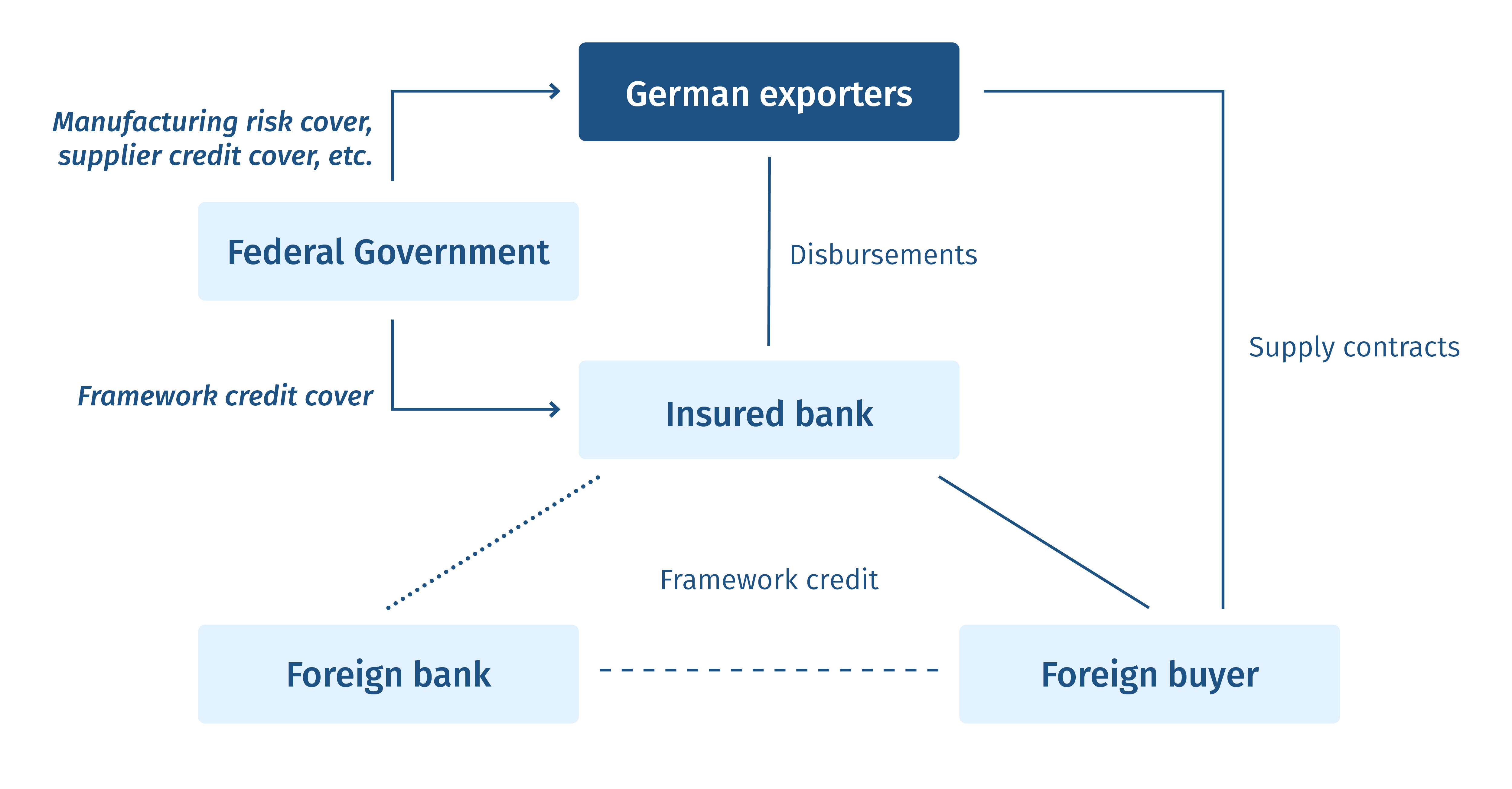

In contrast to buyer credit cover for individual loans, where a separate, independent application process is required for each loan, framework credit cover aims at bundling several loans. Several smaller individual credits granted to one borrower (foreign buyer or bank) and tied to German supplies/services are bundled with framework credit cover under one guarantee. A framework credit cover is applied for in advance, that is quasi “as a reserve”, and is tied to the conclusion of a framework credit agreement between the lending bank and borrower.

The lending bank is granted a maximum amount limiting the Federal Republic’s possible liability, against which the bank can later “book” the individual loans at its sole discretion without the need to involve the Federal Government once again provided that these individual loans meet the general conditions laid down in the guarantee document for the framework credit cover and the basic agreement referred to therein.

Downloads Brochures

Downloads Forms

FAQs framework credit cover

What risks are covered?

Framework credit cover offers protection against payment default if

· the foreign buyer fails to make payment within one month after due date (protracted default)

· the foreign buyer becomes insolvent

· adverse measures taken by foreign governments or warlike events arise

· local currency amounts are not converted or transferred

Framework credit cover is given by the Federal Government for a framework credit agreement concluded between a lending bank and the foreign borrower (buyer or bank). Object of cover, however, is not the framework credit, but the amounts repayable under the individual covered loans disbursed under the framework credit agreement. A maximum ceiling for which cover will be accepted under framework credit cover is established in advance. The goods to be financed under the individual loans must be capital goods. The order value per single transaction should not exceed EUR 10 million. Framework credit cover is therefore ideally suited for medium/long-term business on credit terms and – considering the maximum permissible order values – it aims in particular at the promotion of SMEs.

Who can apply for framework credit cover?

Framework credit cover is available to all German banks, including the branch offices of foreign banks in Germany as well as, under certain conditions, also to foreign banks.

What advantages does framework credit cover offer to the exporter?

If a German exporter was able to obtain only credit terms as payment for his supplies/services, he must always provide financing for the transaction involved. In the event that a framework credit (line of credit) has previously been put in place between a German bank and the foreign buyer for which framework credit cover was already granted by the Federal Government, bank financing will already be at the foreign buyer’s disposal when the sales contract negotiations begin.

Due to the structure of framework credit cover, the amount of administrative work for the bank is considerably smaller than in the case of a conventional buyer credit – and the costs consequently are lower. Also, the bank may be more inclined to provide a buyer credit even if only smaller order values are involved. In that case, a supplier credit will not have to be made available, as would otherwise have been necessary.

Can additional coverage be provided for the exporter?

The granting of framework credit cover in favour of a bank does not exclude the possibility of issuing separate cover in favour of an exporter. The exporter may, for example, apply for separate cover of his pre-shipment risks (see Product Information manufacturing risk cover) or of the non-disbursement risk (see Product Information buyer credit cover).

What horizon of risk is covered?

Taking into account the case-specific circumstances and general underwriting aspects, an appropriate – and prolongable – horizon of risk is fixed for the utilisation of the ceiling established under framework credit cover. Cover for the amounts repayable under the individual loans becomes effective on disbursement of the same. Precondition is, however, that the conclusion of the loan agreement has been duly reported. The Federal Government accepts liability for the loan amounts receivable until they have been repaid in full. The date of expiry of framework credit cover is not relevant in this context.

Do you have any additional questions regarding framework credit cover?

Our experts will be pleased to answer any questions regarding framework credit cover and will guide you step by step through the application process if desired.

Your Contacts