Supplier credit cover

Insuring exports with trade credit cover

We support you in protecting your export business

Easily insuring export transactions? Our supplier credit cover will be the ideal tool for that. This form of trade credit cover enables German exports to insure receivables arising from a single export transaction (supply of goods or services), be it with short or long credit periods.

Worth knowing: You can find out whether this form of cover is suitable for your transaction in question by answering just five questions for the feasibility check or receive an indication as to the amount of the premium payable by means of the premium calculation tool. in the course of the online application process we check your project free of charge and with no obligation, that is before an application for cover is actually submitted.

Supplier credit cover at a glance

Target group

German exporters

Term of payment

- Short-term (up to 2 years)

- Medium/long-term (2 years and longer)

Insurable risks

A supplier credit cover offers protection against payment default, in particular if

- a foreign buyer becomes insolvent

- the foreign buyer fails to make payment within 6 months (protracted default)

- adverse measures are taken by foreign governments or warlike events arise

- local currency amounts are not converted or transferred

- contract performance becomes impossible due to political circumstances

Special features

In principle, cover facilities are available for all countries with the exception of exports with credit periods of up to two years to EU and core OECD countries (i.e. EU member states, Australia, Canada, Iceland, Japan, New Zealand, Norway, Switzerland, the United Kingdom and the United States).

Premium

- One-off premium calculated as percentage of the order value covered (interest excluded) as well as specific administrative fees

- For a detailed calculation, there is a premium calculation tool available

Uninsured portion

- 5% for political risks

- Normally 15% for commercial risks; upon application, the uninsured percentage can be reduced to 5% against the payment of a premium surcharge

Supplier credit cover: Your advantages at a glance

Safe

- Protection against commercial and political risks in connection with foreign business

- Making the granting of payment periods for foreign buyers possible

- Growing in new markets to expand your own internationalisation strategy

- Reduction of pressure on your liquidity

- Sale of accounts receivable to relieve pressure on the balance sheet

Simple

A feasibility check offers you the possibility to check quite easily whether supplier credit cover is suitable for your transaction.

Digital

You can apply for supplier credit cover quite easily in our customer portal myAGA.

Combinable

Supplier credit cover can be combined with many other forms of cover – for example with manufacturing risk cover, confiscation risk cover, contract bond cover, forfaiting guarantee or a counter-guarantee – in order to enhance the risk protection.

How does supplier credit cover work?

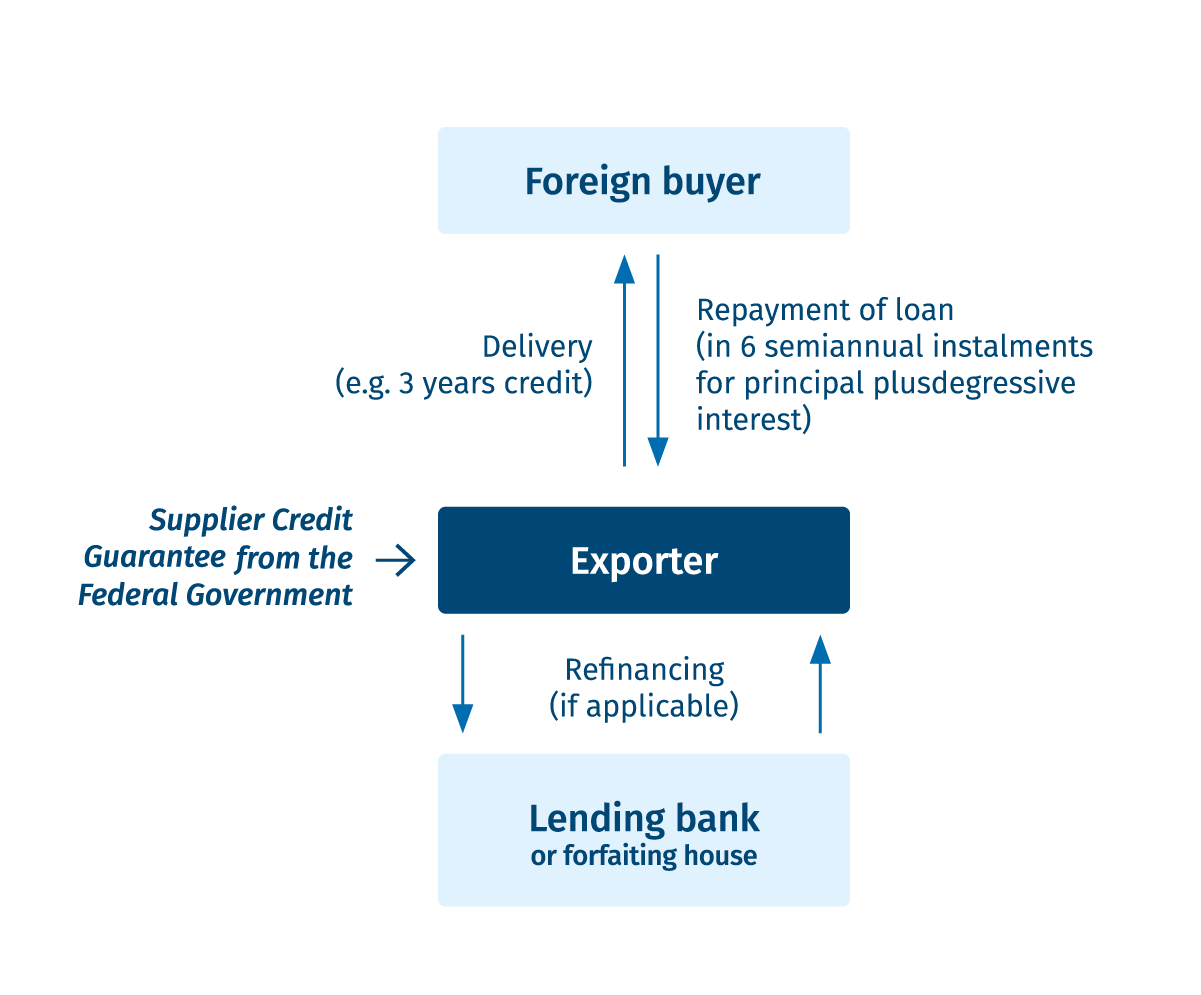

In the case of supplier credit cover, the exporter allows the foreign buyer time for payment and bears the risk of payment default arising in connection with this loan himself. Short-term supplier credit guarantees (repayment terms not exceeding 24 months) are offered by the Federal Government mainly for cover of the supply of consumer goods, raw materials, semi-finished goods, or spare parts. Supplier credit guarantees for medium-and long-term transactions with repayment terms of more than 24 months are applied primarily in the capital goods and plant sector.

Worth knowing: The counterpart of a supplier credit is a buyer credit where a bank extends a loan to the foreign buyer with which the exporter is paid already when the goods are shipped. The exporter can then take out cover for the remaining risk of non-disbursement of the buyer credit.

Your path to obtaining cover

You contact us - we advice you

You file an application fpr cover

We check

your application

We provide cover

Solar energy for 300 villages in Senegal

300 villages in remote areas of Senegal will be equipped with photovoltaic systems and electrified. The Federal Government supports this project with supplier and buyer credit cover. The medium-sized GAUFF Engineering from Nuremberg is planning and realising this project.

Applying for supplier credit cover

You can apply quite easily for this product online in the myAGA customer portal. Please submit your online application there in order to apply for cover for your export transaction under a supplier credit cover. For this purpose please register once and comfortably with just a few steps with our myAGA customer portal. If you already use myAGA, you can log on directly with your access data.

If you need assistance with the application or if you have any questions regarding the suitable product for you, please contact our business consultants.

Downloads Brochures

Downloads Forms

FAQs supplier credit cover

What alternatives exist?

- For standardised transactions, completely digital and processed faster: hermes cover click&cover EXPORT

- For the provision of services: export credit cover for service providers

- For leasing transactions: leasing cover

- For several deliveries to a foreign buyer on short payment terms: revolving supplier credit cover

- For all deliveries to foreign buyers in selected countries short payment terms: wholeturnover policy (APG), wholeturnover policy light (APG-light)

Which export markets are covered?

As a rule, in the case of contracts with repayment terms not exceeding 2 years, the debtor must be domiciled in a non-EU or non-OECD country because these risks are classified as “marketable”. Additional information can be found on the page “marketable risks”.

What horizon of risk is covered?

Cover takes effect with the respective shipment of the goods and/or commencement of services, and only ends with full payment of the covered amount owing.

Can supplier credit cover be used for refinancing?

The claims arising under the supplier credit cover may – together with the title to the amounts receivable under the export contract – be assigned to banks and forfaiting houses for refinancing purposes.

Do you have any additional questions regarding a supplier credit cover?

Our experts will be pleased to answer any questions regarding a supplier credit cover and will guide you step by step through the application process if desired.

Your Contacts