Welcome

to your financing expert for the India & South East Asia region

Amol Mane

Competent support in India

Amol Mane heads the Financing Competence Center India at the Delegation of the German Chamber of Commerce and Industry in Mumbai. He has over 25 years of experience in marketing, sales and strategic management. Previously, he was responsible for global product marketing at ModuleWorks and Hexagon Manufacturing Intelligence and also worked at Dassault Systèmes and Sulzer India.

In 2024, he was recognized as one of the "24 Voices of Manufacturing" of the year for making local manufacturing processes in India more efficient and competitive through technology-driven innovation.

In his current role as Representative for Export Credit Guarantees of the Federal Republic of Germany, he supports German exporters in finding customized financing solutions and technologies in the Indian market - always with the aim of strengthening local value creation, promoting innovation and deepening bilateral trade relations in the long term.

Advice and protection for your successful market entry in India

The Indian market is dynamic and full of opportunities. To succeed, German exporters need in-depth local knowledge and tailor-made financing solutions.

The Federal Government's export credit guarantees support German exporters in India and foreign importers by:

- protecting against economic and political risks,

- providing access to a global network of financing experts,

- enabling sustainable business opportunities in India and worldwide.

Since July 2025, financing expert Amol Mane has been based in Mumbai. He supports foreign importers, local banks, and German exporters on site. With his knowledge of the different interests of buyers, banks, and exporters, he helps bring them together for long-term, successful business relationships.

Through individual consulting, participation in trade fairs and delegation trips, as well as targeted networking, he actively assists German companies entering the Indian market and expanding their business activities.

Rely on the Federal Government's export credit guarantees – your strong partner for secure and successful export business in India and worldwide.

Your export opportunities in the India region

Market opportunities & potential

"India is one of the most dynamic growth markets in the world. The enormous demand for infrastructure, high-tech and sustainable solutions opens up unique business opportunities for German exporters - across numerous sectors."

Trust

& proximity on site

"Our presence in India creates proximity and trust. Together with you, we accompany customer meetings directly on site - solution-oriented, practical and with a clear goal: to maximize your chances of success in the Indian market."

Financing offers as a competitive advantage

"If you want to be successful in India, you need strong financing solutions. Our export credit guarantees not only secure your business, but also enable flexible financing models for local partners. This gives you the decisive competitive edge."

Focus on India: Financing expert Amol Mane on market opportunities, risks and strategic prospects

Overview Country Information | Region India

Do your foreign customers know the advantages of Hermes Cover?

Share our information on Your way to buy 'Made in Germany' for foreign importers with your customers:

Your way to Hermes cover

Talk to me

Do you have a question, need advice or want to send me a message?

Would you like a consultation (together with your bank) on site or via video call?

Talk to me and I will take care of your request.

I can advise you on all questions relating to export insurance

During the consultation, we discuss your specific export project in detail, clarify questions and find the right type of cover for your foreign business.

How to submit an application

It's very easy in the myAGA customer portal. Register via this link: my.agaportal.de.

I will assist you with the application process, including the cost indication, and am available to answer any questions you may have.

We check your application

The main criteria when assessing your export business for cover with an export credit guarantee are:

- The creditworthiness of the foreign customer

- The respective country risk

- The proportion of German value added

- Usual contractual terms (payment terms and term)

- Compliance with environmental, social and human rights standards

We secure your export business

After a positive check, you will receive

Before signing the contract:

- a binding, provisional commitment

And after conclusion of the contract

- the letter of acceptance (final commitment)

- the declaration of warranty (certificate of cover)

- the invoice

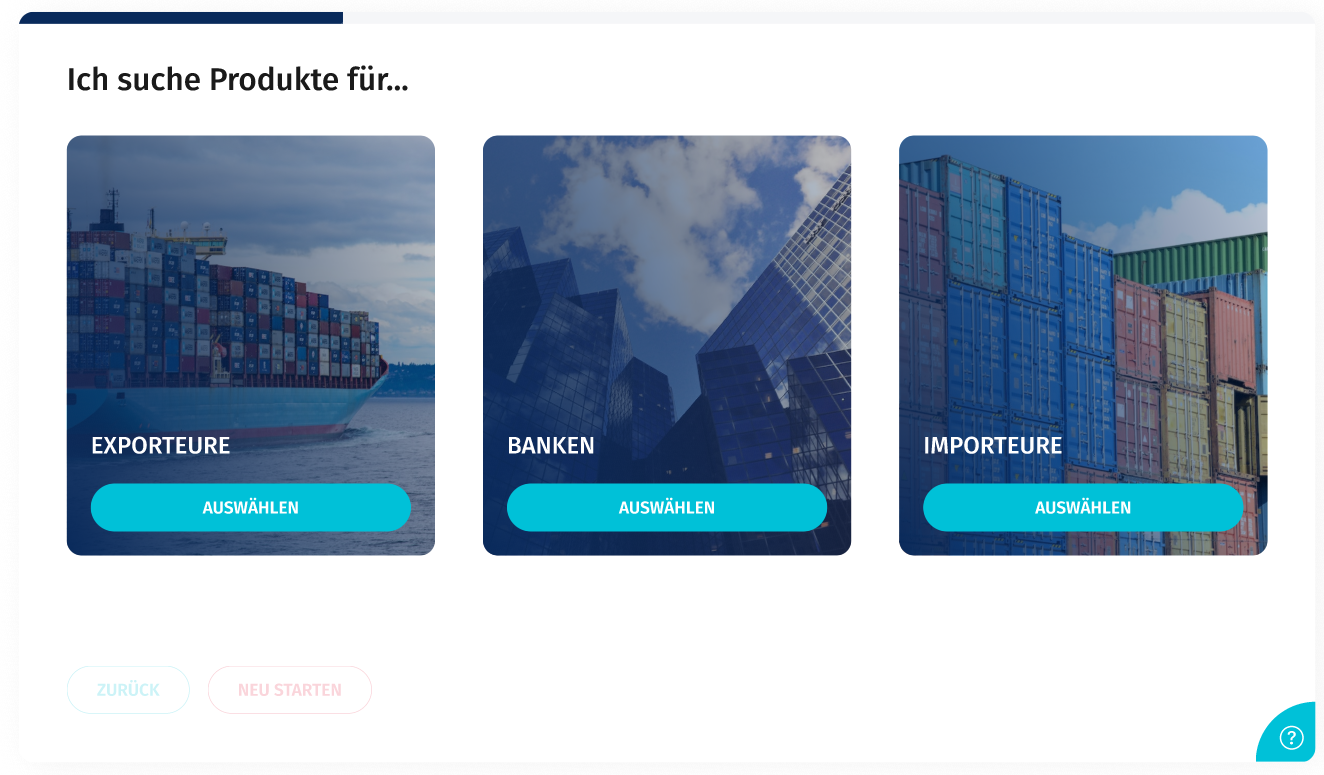

Which export credit guarantee suits your project?

We offer you various options for securing your receivables from export transactions or from the financing of a foreign transaction:

Downloads

With us you are always informed

You can find relevant news in the ECG Report or register directly for the newsletter with all the information on export credit guarantees. You can also find events near you in our event portal, e.g. our IHK consultant day.